small business restructuring

success rates

Choosing the right practitioner matters

At Business Reset, we take your Small Business Restructure (or SBR) seriously. You want the best chance of success when you start your Small Business Restructure. When you have debt you can’t pay, it’s your one chance to keep your company, reduce ATO debt, avoid liquidation, keep trading, and protect your personal assets. When you plan an SBR, the experience and success rate of your SBR practitioner matters.

Many directors who are researching a Small Business Restructure do not know how to compare practitioners. There is very little public information about SBR success rates or the number of SBRs completed by individual liquidators. You may see an online ad for “80% ATO debt reduction” and then speak to a marketing agency, a pre- insolvency advisor or someone else who is not a registered liquidator. They will not have an SBR track record you can check. You cannot see how many restructures they have handled or whether their clients received an approved SBR plan.

We see directors place trust in advisors who promise easy results, take payment, and then fail to deliver a successful SBR. There are no refunds. You only get one chance at your restructuring plan. When an SBR fails, the company often ends up in liquidation.

Your outcome depends on the practitioner

Your outcome depends on the individual SBR practitioner managing your restructure, not the size of the firm.

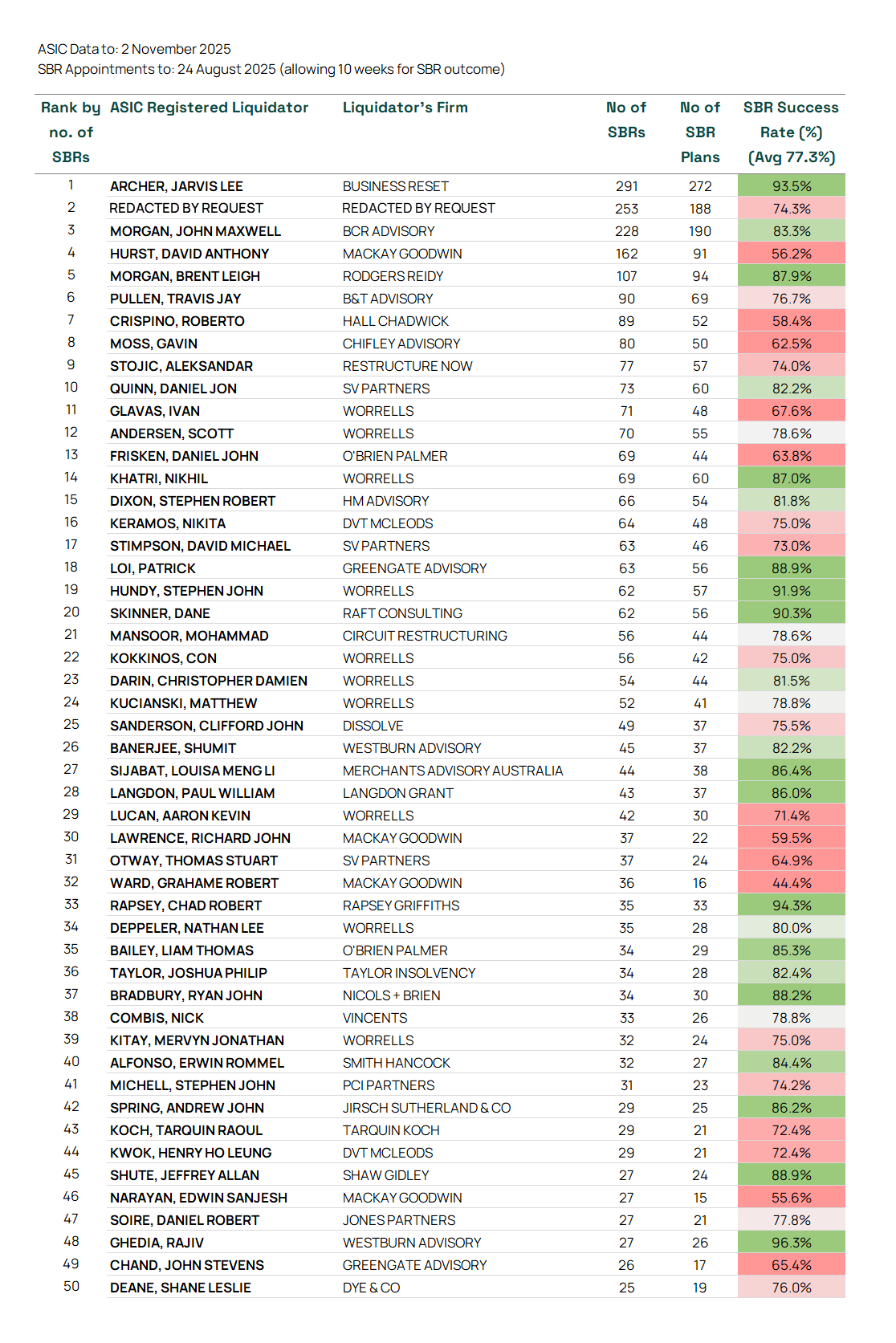

Below you will see the ASIC data for each of the 50 SBR practitioners who have done the most SBRs across Australia. It shows:

Their order by number of SBRs

Name of each registered liquidator who acts as the SBR practitioner

Number of SBRs completed

Number of SBRs that successfully became SBR Plans

Their SBR success rate, colour coded against the national average SBR approval rate of 77.3% percent

Click to view full size

Transparency on who you're dealing with

This information gives you a clear view of who you are dealing with. You can compare success rates, track record, and the experience of the practitioner before you choose who to trust with your small business restructure.

A successful Small Business Restructure needs proper preparation. It is not only about satisfying the ATO. It is also about business viability and improving how the business runs so you have a better cash position after the restructure.

A well prepared SBR helps your company avoid liquidation, reduce ATO debt, and keep your business trading.

It can be tough fixing your business to prepare for SBR success. But don’t be tempted by someone telling you it’s easy and they make it all happen for you. Directors we’ve seen do this end up in the regrettable position that their SBR is unsuccessful, their only option is liquidation and the $15,000 or more they paid for the SBR, they have to pay again to a liquidator.

As featured in

Get the process started

It's free, instant and 100% confidential